The CIBIL score is the most important tool in a person’s financial life since it determines the possibility of getting loans, credit cards and other financial products or services. This score needs to be effectively monitored to obtain financial stability and simplify credit access. In this article you will learn what exactly are CIBIL scores, what influence them and how to effectively improve upon them in actual practice

Understanding CIBIL Scores

What is a CIBIL Score?

CIBIL score is a number calculated between 300 and 900 which determines the credit reputation of a person. In its simplest terms, it is created by the Credit Information Bureau of India Limited, CIBIL based on your credit data and monetary character.

How is it calculated?

CIBIL scores are calculated considering the following factors:

Why is it Important?

A high CIBIL score increases your chances of loan approval, better interest rates, and favorable terms. It demonstrates your reliability as a borrower to lenders.

Key Drivers of Your CIBIL Score

Strategies to Improve CIBIL Scores

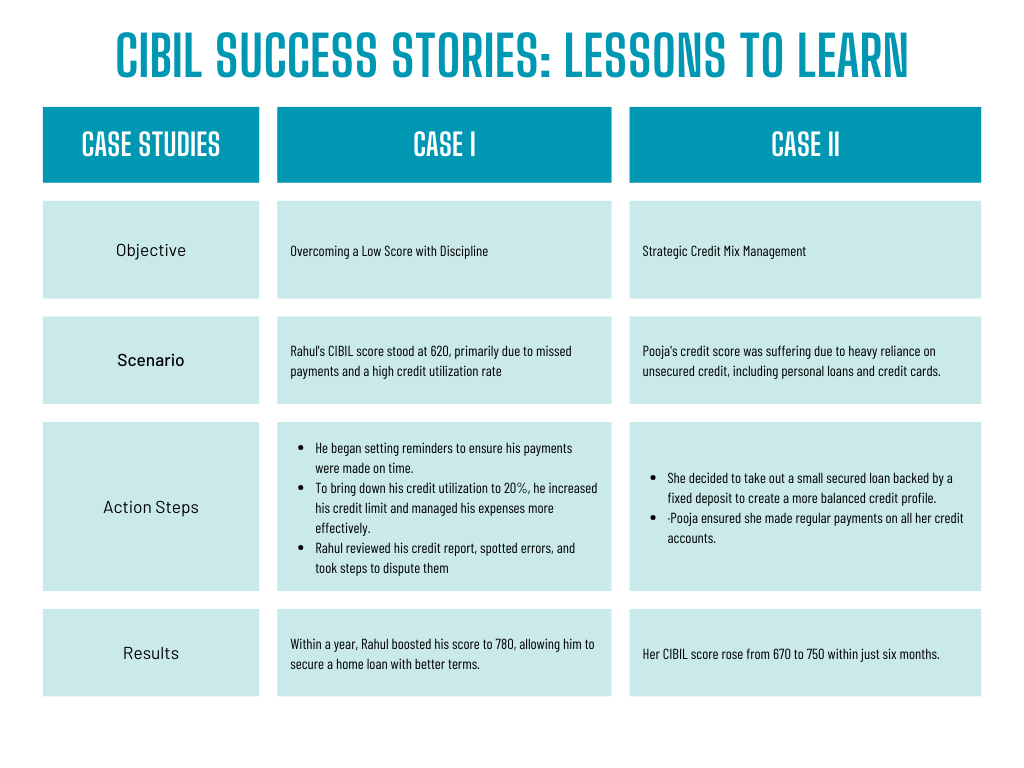

Real-World Examples and Case Studies

Common Misconceptions About CIBIL Scores:

- Checking Your Score Hurts It: There’s nothing to worry about, it’s called a soft inquiry and doesn’t affect your score. Hard inquiries from lenders only impact it.

- Closing Old Accounts Improves Your Score: Don’t close old credit accounts on a whim. This can cut your credit history, which, oddly enough, might hurt your score.

- Zero Debt Equals a High Score: Interestingly enough, having no debt doesn’t always help. If you have no credit history, you might be suitable for lower score because the lender can not evaluate your creditworthiness.

Unlock Your Potential with a Strong CIBIL Score

Just like good penny saving tips, building a good credit score requires a commitment to good and consistent work, financial responsibility, and responsible credit management. If you can understand on what you may find yourself with high or low score, and use the strategies given in this article, you can unlock better financial prospects. Don’t forget, a good CIBIL score isn’t just a number but instead it’s your selfless way to achieve financial independence and stability. Work towards excellence today and make sure you have a great CIBIL score!

Your financial success starts here!